-

iestinstrument

Korea’s SK On Offers Voluntary Separation Program for Employees

South Korean battery firm SK On unveils layoff plan

Summary

- SK On Announces Layoff Plan: South Korean battery manufacturer SK On revealed a layoff plan as part of efforts to increase efficiency and respond to declining electric vehicle (EV) market demand.

- Options for Employees: The company is offering employees the choice of voluntary separation (with 50% of annual salary and a cash incentive) or unpaid leave to pursue higher education (with tuition support).

- Impact and Scope: This measure affects SK On’s 3,500+ employees in South Korea who joined before November 2023.

- Challenges in the EV Market: Global EV demand has slowed, impacting SK On’s major customers like Ford, Hyundai, and Volkswagen. Recent model cancellations and production delays by automakers reflect tough market conditions.

- Company Performance: SK On has faced financial struggles, reporting operating losses and failing to achieve profitability since its 2021 spin-off from SK Innovation.

- Broader Industry Context: The layoffs come amidst wider industry cutbacks, including Volkswagen’s potential closures and job security concerns, highlighting a turbulent period for the global EV sector.

South Korean battery maker SK On said Thursday (Sept. 26) it plans to lay off employees in a bid to improve efficiency in hopes of remaining competitive in the challenging electric vehicle market.

SK On to offer employees choice of voluntary separation or unpaid leave for degree study. If employees accept the voluntary severance package, the company will offer them 50 percent of their annual salary and a cash incentive. Employees who choose to take an unpaid leave of absence to pursue a degree will receive 50 percent of their two-year tuition from SK On. If the employee earns a degree related to their specialty and returns to work, they will also receive another 50 percent of their tuition.

The above proposal applies to Korean employees joining SK On by November 2023, which employs more than 3,500 people at the company’s headquarters in Seoul, South Korea.

SK On explained, “This is a proactive measure to build a lean and flexible workforce to better respond to changing electric vehicle market conditions.”

The company added, “While the company strives to improve efficiency and lay the foundation for sustainable growth, we will fully support the career development of our employees, who have contributed to our success as a top battery manufacturer.”

Battery shipments for electric vehicles have been declining amidst the current global slowdown in electric vehicle sales, and SK On’s major customers include Ford, Hyundai, Volkswagen, and others, and these automakers are currently operating in a very challenging environment.

Recently, Ford, General Motors and other automakers have delayed or even canceled new electric models to avoid investing large sums of money in models that consumers are not buying as fast as expected. Ford announced it was canceling its electric SUV and delaying its electric pickup truck, the F-150, while GM postponed the launch of its electric models for a second time.

The latest global power battery statistics released this month by South Korean research organization SNE Research show that in the first seven months of this year, SK On ranked fourth in the world with a market share of 4.7%, ranking behind South Korean company LG New Energy.

Two Chinese companies CATL (300750.SZ) and BYD (002594.SZ) dominated the global lithium battery industry with a combined 53.7% market share.

SK On exposed itself to crisis mode in July this year, and attributed the move to disappointing electric vehicle sales to downstream customers in Europe and the United States.

Lee Seok-hee, who became SK On’s chief executive last December, said in a letter to employees, “We are desperate and must work together.”

Volkswagen is in the midst of its biggest crisis in decades. Earlier this month, Volkswagen announced that it was considering closing its factories in Germany and canceling job security agreements for its employees. This series of moves has led to growing tensions between the company’s executives and workers, and labor negotiations between Volkswagen and German unions have now officially begun.

Looking at SK On’s performance, it has never made a profit since it was spun off from SK Innovation in 2021, recording an operating loss of 460 billion won ($346.1 million) in this year’s April-June quarter, compared with a loss of 332 billion won in the previous quarter.

Shares of SK Innovation were down 0.58 percent as of Thursday’s close, while South Korea’s Composite Stock Price Index closed up 2.9 percent on the same day.

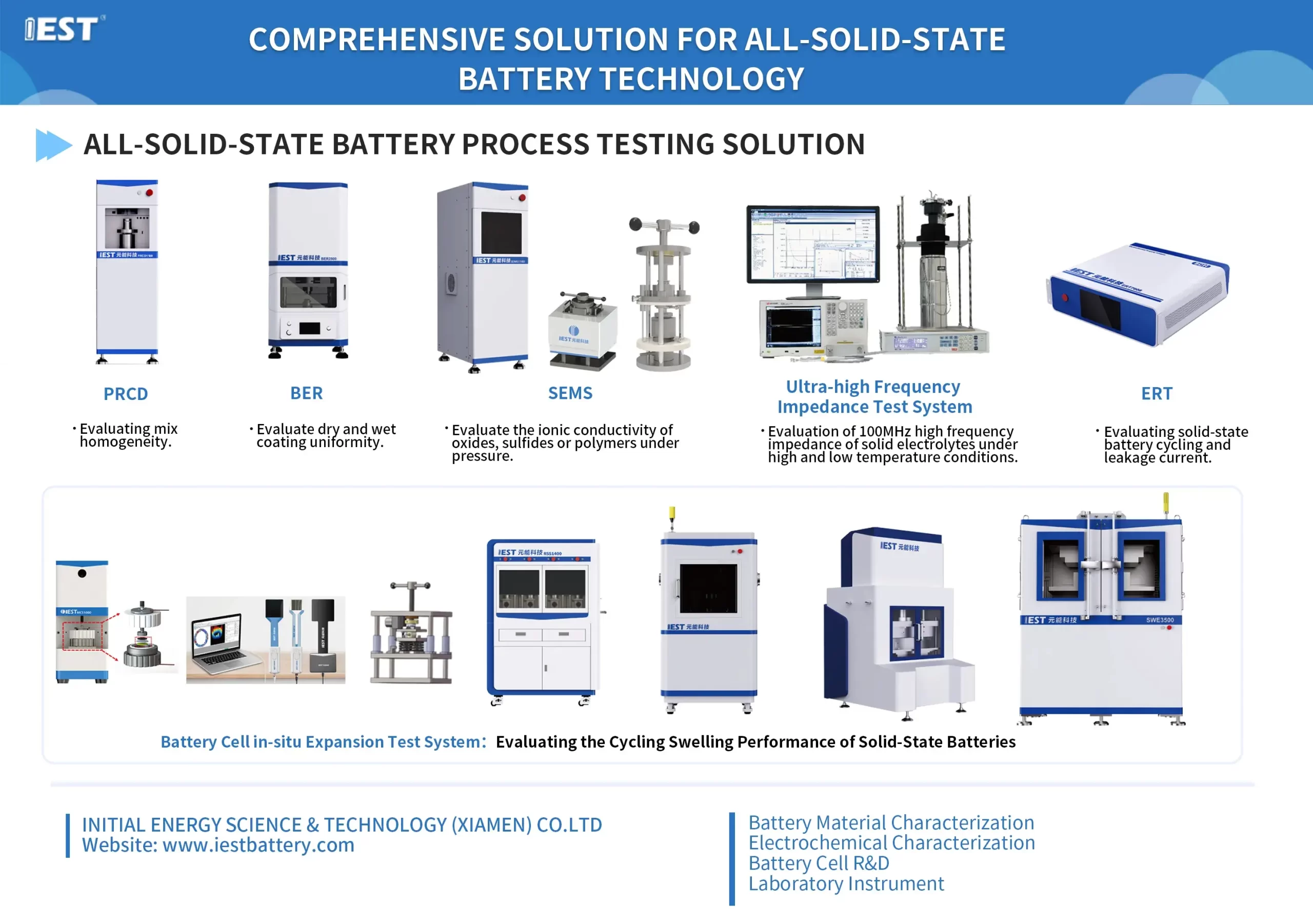

Lithium Battery Testing Solutions Recommend:IEST Instrument

IEST is a high-tech enterprise focusing on R&D and production of lithium ion battery tester. IEST is a professional manufacturer that integrating laboratory instrument R&D and production, method development, instrument sales and technical services. Committed to providing leading testing solutions and services for the global new energy field, IEST company serves key clients like CATL, BYD, Huawei, Svolt, GM, Leyden, Sintef, Factorial, Cabot, Cuberg.

Subscribe Us

Contact Us

If you are interested in our products and want to know more details, please leave a message here, we will reply you as soon as we can.