-

iestinstrument

SK On Announces Layoff Plan Amid Weak EV Demand — What It Means for Employees and the Battery Industry

1. Introduction

South Korean battery maker SK On has unveiled a voluntary layoff package and an unpaid-leave-for-study option as it seeks to cut costs and boost agility amid slowing electric vehicle (EV) demand. The measures affect more than 3,500 employees in South Korea and come as automakers delay or cancel EV models and industry leaders face mounting financial pressure.

2. Layoff Details and Employee Options

-

Announcement: SK On unveiled a workforce restructuring plan on Sept. 26 to improve efficiency and adapt to weaker EV demand.

-

Scope: The measures apply to SK On staff hired by November 2023 — the company says this covers over 3,500 employees at its Seoul headquarters (SK On number of employees).

-

Options for employees: Voluntary separation (50% of annual salary + cash incentive) or unpaid leave to pursue a degree (50% tuition coverage initially). Employees who return with a relevant degree can receive the remaining 50% tuition reimbursement.

-

Market backdrop: Global EV sales have slowed; major automaker customers such as Ford, Hyundai and Volkswagen have reduced or delayed EV model rollouts.

-

Company performance: SK On has yet to post a profit since its 2021 spin-off from SK Innovation and reported steep operating losses in recent quarters.

3. Market Context and Business Challenges

The restructuring reflects broader headwinds in the global EV sector. SK On, which supplies major automakers such as Ford, Hyundai, and Volkswagen, has been adversely affected by slowing EV demand. These OEMs are themselves contending with market realities—Ford, for example, recently canceled an electric SUV model and delayed the release of its F-150 electric pickup. Similarly, GM has postponed several electric vehicle launches.

Amid these challenges, SK On has yet to achieve profitability since its spin-off from SK Innovation in 2021. The company reported an operating loss of 460 billion won (approx. $346.1 million) for the April–June quarter this year, deepening from a 332 billion won loss in the prior quarter.

4. Why This is Happening Now

The global EV market has cooled, pressuring battery suppliers that depend on automaker demand:

-

Several carmakers, including Ford and GM, have delayed or canceled EV programs and model launches to avoid overcapacity amid sluggish consumer uptake.

-

Market-share dynamics remain concentrated: SNE Research figures show dominant positions for firms such as CATL and BYD, while SK On ranks among top global suppliers but faces intense competition.

-

SK On itself has recorded consecutive operating losses since the spin-off, heightening urgency for cost control.

5. Wider industry context

SK On’s move echoes broader headwinds across the EV and battery sectors:

-

Volkswagen has signaled potential plant closures and wrestled with labor negotiations in Europe, exemplifying pressure across auto supply chains.

-

Battery makers worldwide are rebalancing capacity and costs as they chase profitability and operational efficiency.

-

Within the SK corporate family and beyond, concerns among SK Energy employees and other affiliate staffs have grown as firms reconsider investments and workforce plans.

6. Impact and outlook

-

Employees: The package offers choices rather than immediate forced layoffs, but it still signals a painful restructuring that will affect thousands. SK On number of employees in Korea (3,500+) means the program could touch a significant portion of its domestic workforce.

-

Customers & partners: Automakers that rely on SK On for cells and modules may see adjustments in supply plans; SK On must balance cost cuts with maintaining production readiness.

-

Investors & markets: SK On’s parent and related stocks have shown sensitivity to results and announcements; weaker profitability continues to weigh on investor sentiment.

7. Conclusion

SK On’s layoff plan highlights the mounting pressures within the EV battery sector. By offering voluntary severance and education support, the company aims to balance operational streamlining with employee welfare. How SK Battery America and other international divisions may be affected remains a point of observation as the company continues adapting to dynamic market conditions.

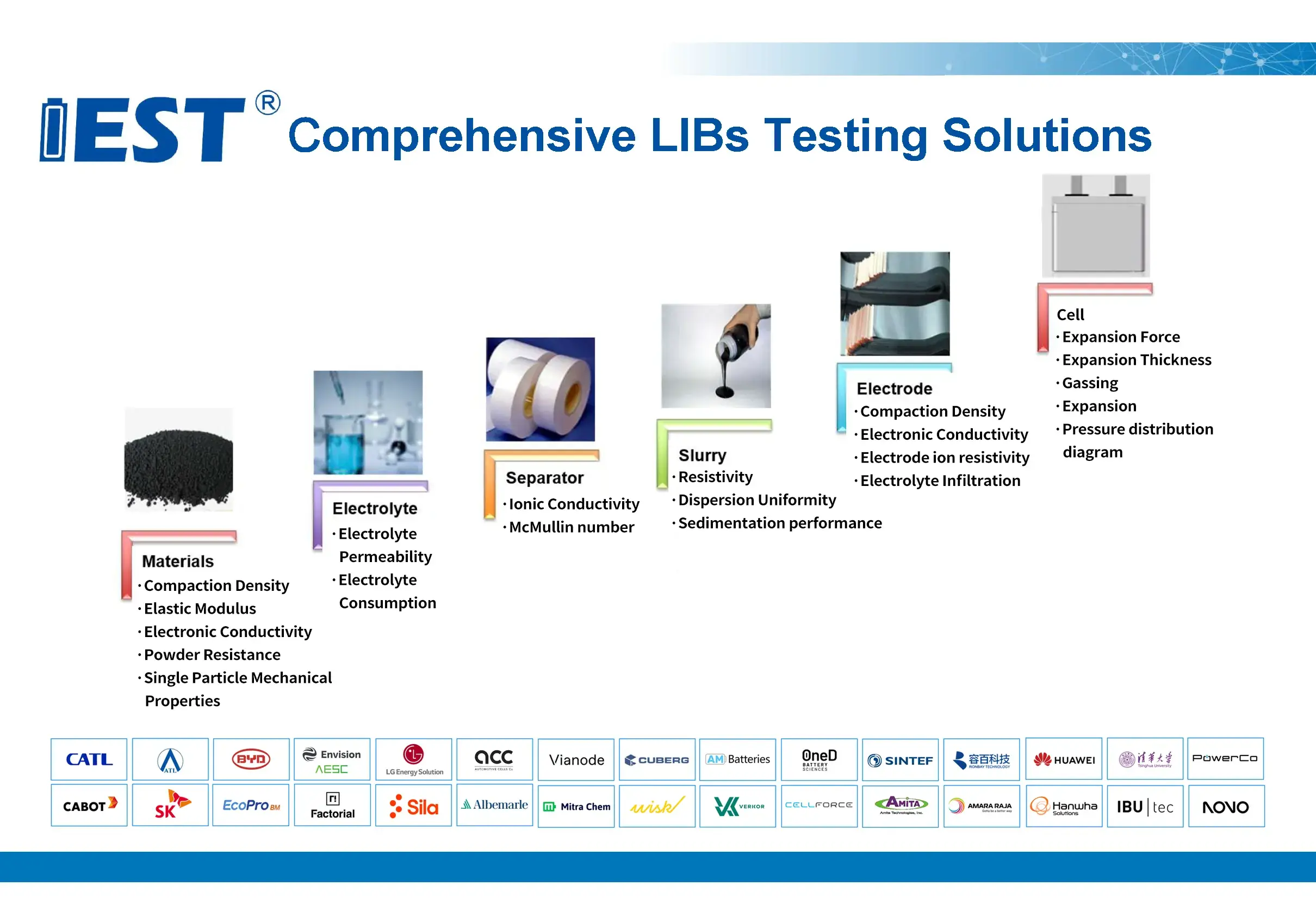

8. Lithium Battery Testing Solutions Recommend:IEST Instrument

IEST Instrument a pioneer in lithium-ion battery testing, is dedicated to delivering efficient and cutting-edge testing solutions for global electrochemical energy storage, empowering clients to achieve R&D breakthroughs and quality enhancement. The company’s core team comprises seasoned experts in materials science, electrochemistry, and automation, backed by over 100 authorized patents. Its testing equipment has been widely adopted in power batteries, energy storage systems, and materials science research, serving clients across more than 20 countries and regions, including China, Europe, North America, and Southeast Asia. To date, IEST has provided world-leading innovative testing solutions to over 900 global customers, earning widespread recognition for its technological excellence and industry impact.

Contact Us

If you are interested in our products and want to know more details, please leave a message here, we will reply you as soon as we can.