-

iestinstrument

Solid-state Batteries 25 Q&A: Key Technical Challenges and Market Prospects

1. Technical Features and Validation of Solid-State Batteries

The fundamental characteristics of solid-state batteries are consistent with those of liquid batteries, and the evaluation criteria remain unchanged regardless of battery type. The development of solid-state batteries requires careful attention to the coupling of materials, processes, and equipment, with practical validation being critical. The technical capability of solid-state battery can be demonstrated through the production of high-capacity cells, with a single-cell capacity of 30Ah serving as an important benchmark. Energy density is a core metric, and single-cell energy density should exceed 300 Wh/kg. Achieving higher energy density is challenging, requiring the reduction of auxiliary components and the precise placement of materials. Charge-discharge rate is also a crucial metric that should be maximized.

2. Current Industry Status and Challenges of Solid-State Batteries

Solid-state battery have reached a usable stage but have yet to achieve significant breakthroughs in engineering and commercialization capabilities. No large-scale commercial examples exist, and solid-state battery are in the phase of proving their engineering and commercial viability. Cost remains a challenge, with current solid electrolytes being expensive. Although prices may decrease over time, achieving cost parity with liquid electrolytes is unlikely. Solid-state battery face difficulties in replacing liquid batteries on a large scale, especially given the low-cost advantage of lithium iron phosphate.

3. Technological Pathways and Market Expectations for Solid-State Battery

The technological pathways for solid-state battery include semi-solid and fully solid-state configurations. The market’s focus on semi-solid batteries is less intense compared to fully solid-state battery, with semi-solid batteries viewed as a transitional route. However, the market attraction differs, with fully solid-state battery needing to address interface handling and material stability issues. Different types of solid electrolytes have varying application prospects, with sulfide-based solid-state battery expected to see better applications by 2030. Oxide systems may progress faster, with CATL (Contemporary Amperex Technology Co., Limited) planning to achieve significant breakthroughs by the end of next year. Composite batteries of polymers and oxides are also under exploration.

4. Market Competition and Enterprise Layout in Solid-State Battery

Major enterprises like CATL have invested heavily in solid-state battery research, but market elasticity expectations are low. Smaller companies are more attractive in capital markets, drawing attention despite having less R&D strength due to their high risk-reward profile. Leading companies have a more complete layout, but market elasticity issues impact capital enthusiasm. Research in solid-state battery involves various material systems, such as halide and oxide combinations. CATL has made progress in halide solid electrolytes, though not widely publicized, with research results showing good overall performance.

5. Q&A

-

Q: At what stage is the development of solid-state batteries in the industry?

A: Solid-state battery have been of great interest since their invention, but the industry and capital markets have faced some setbacks. Currently, the market’s understanding of solid-state battery is deepening. The development of solid-state batteries requires attention to technical validation, particularly in the coupling of materials, processes, and equipment. Despite high market expectations, information asymmetry remains a significant issue, requiring careful analysis.

-

Q: What are the key technical indicators of solid-state batteries?

A: The key technical indicators of solid-state battery include cell size, energy density, and charge-discharge rate. First, the larger the cell size, the more it demonstrates technical strength, with a single-cell capacity of 30Ah being a critical reference standard. Second, energy density is a core metric, especially in electric vehicles and specific application scenarios, where a single-cell energy density below 300 Wh/kg is considered low. Finally, the charge-discharge rate, which refers to the speed of charging and discharging, presents challenges for solid-state battery, making it essential to maximize this rate. Overall, the higher these indicators, the more mature and promising the battery technology is.

-

Q: How does the cycle life of solid-state batteries compare to liquid batteries?

A: The cycle life of solid-state battery has not yet reached the level of liquid batteries. The national recommendation is for the cycle life to ideally reach 1,000 cycles, but this requires specific measures to extend it, such as using low-rate cycles for energy storage. Compared to liquid lithium iron phosphate batteries, solid-state batteries still have room for improvement in cycle life.

-

Q: What is the market’s view on semi-solid versus fully solid-state batteries?

A: The market’s attention to semi-solid and fully solid-state batteries differs. Semi-solid batteries are seen as a transitional route but are less attractive than fully solid-state batteries. The concept of semi-solid batteries is less eye-catching than fully solid-state batteries, with the market preferring to compare them to traditional liquid batteries rather than directly to fully solid-state batteries.

-

Q: What stage is the solid-state battery industry currently in?

A: Solid-state battery have reached a usable stage but still need to prove their engineering and commercialization capabilities. Although several types of solid-state batteries are available for use, they still need to be evaluated based on specific application fields to determine their engineering excellence. No large-scale commercial success stories have been observed, and solid-state batteries are still in the process of proving their engineering and commercial strength.

-

Q: What are the pros and cons of different solid-state battery technological pathways?

A: Different solid-state battery technological pathways have their respective advantages and disadvantages. Polymer electrolytes offer good processability but lack stability and conductivity; oxide electrolytes are stable but suffer from poor conductivity and interface control; sulfide electrolytes have high ionic conductivity but pose safety risks. In scenarios with high electric vehicle penetration, sulfide electrolytes may face safety risks, especially in the event of collisions or external fire sources.

-

Q: What issues do solid electrolytes face in practical applications?

A: Solid electrolytes face compatibility and safety issues in practical applications. While solid electrolytes are safer than liquid electrolytes, different types of electrolytes have varying strengths and weaknesses when paired with electrodes. Currently, no solid electrolyte or liquid electrolyte is entirely satisfactory, necessitating ongoing problem-solving in practice.

-

Q: How does the cost of solid-state batteries compare? Is it likely to decrease to the level of liquid batteries?

A: The cost of solid-state batteries is currently high; for example, the cost of LATP sulfides is several hundred thousand yuan, while the cost of oxides like LLZO or LCTO is several hundred thousand yuan as well, with sulfides reaching up to two million yuan. While these costs may decrease in the long term, reaching the cost level of liquid batteries is unlikely. Comparing lithium content and the expensive nature of the elements, the cost of solid electrolytes may be similar to that of ternary cathode materials. However, sulfides, due to their complex production processes and lack of inexpensive synthesis methods, may have even higher costs.

-

Q: Can solid-state batteries replace liquid batteries on a large scale?

A: Solid-state battery face difficulties in replacing liquid batteries on a large scale, especially in areas where lithium iron phosphate’s cost control advantage is strong. Solid-state battery may have application opportunities in certain niche markets, such as electric vehicles and high-end 3C products, where higher energy density and compact size are required. However, solid-state battery currently do not affect the fundamental logic of the lithium battery market, with lithium iron phosphate remaining dominant.

-

Q: What challenges exist in the manufacturing processes of solid-state batteries?

A: The manufacturing processes of solid-state batteries face various challenges. Traditional high-temperature sintering processes are suitable for small-scale batteries but present numerous issues in large-scale production. Using traditional processes such as coating, extrusion, and rolling can make them more similar to the production methods of liquid batteries, but challenges in electrode material compatibility and scaling up production remain. Additionally, in-situ solidification technologies are being explored, which involve converting liquid-phase materials into solid-phase materials through heating or UV light exposure, but these technologies are still immature.

-

Q: What progress has been made in equipment support and material processes for solid-state batteries?

A: Solid-state battery companies have invested significant effort in materials, processes, and equipment. Penghui Company has relatively few patents in the solid-state battery field, but it has modified all-solid-state batteries, using lithium vanadium oxide as the solid electrolyte layer and modifying it through in-situ polymerization of the electrolyte. Although lithium vanadium oxide is not stable enough with lithium metal anodes, the battery’s cycle life and charge-discharge rate performance have improved through modification. Additionally, Penghui has modified the surface of the solid electrolyte with barium carbonate, improving ionic conductivity. These modifications have improved the overall performance of the battery.

-

Q: What scientific and engineering challenges do solid-state batteries face?

A: Scientifically, no particularly outstanding solid-state batteries have emerged. From an engineering perspective, many processes for solid-state batteries are still in development, with the process complexity of solid-state batteries being higher than that of traditional liquid batteries. While dry electrode methods can simplify some processes, other methods, such as sintering and evaporation, are more cumbersome. Therefore, the scientific and engineering challenges for solid-state batteries mainly lie in process complexity and material stability.

-

Q: What is the market demand and development direction for solid-state batteries?

A: The development of solid-state batteries must rely on existing liquid battery material systems and be improved to meet market demands. Assessing market demand is complex, similar to previous decisions regarding separators and cathode materials. If improved semi-solid-state batteries can reduce costs and enhance overall performance, leading companies and their supply chains will gain an advantage. Investors seeking higher risk-reward profiles and elasticity need to focus on companies with innovative materials, technical parameters, or application scenarios. These companies may not yet be commercialized but have the potential for significant growth with low market capitalization. Overall, leading companies have made substantial investments in solid-state batteries, and while their growth curves may not be as steep as those

-

Q: What improvements have been made in the material systems of solid-state batteries, and how do R&D costs affect their commercialization

A: Material systems for solid-state batteries, particularly solid electrolytes, continue to advance. Three years ago, halides were largely unknown, but now they are widely studied and applied. The basic structure and atomic composition of these batteries are evolving. However, R&D is expensive, requiring tools like energy spectrometers, synchrotron radiation sources, and aberration-corrected electron microscopes. This high cost poses a significant challenge to commercialization.

-

Q: How is the commercialization of polymer batteries progressing, and what is the outlook for polyethylene oxide (PEO) in solid-state batteries?

A: Commercializing polymer batteries is challenging. While PEO solid-state battery prototypes can be made, they do not offer significant performance or cost advantages. Engineering efforts in PEO systems are extensive, but challenges include post-synthesis heating and insulation, as well as handling multilayer structures. Additionally, PEO is unstable at high voltages, requiring treatment of the cathode, making its commercialization prospects less promising.

-

Q: What is the expected timeline for the commercialization of solid-state batteries?

A: Solid-state batteries are still immature, lacking commercial products. The timeline for commercialization varies depending on the type of solid electrolyte, and specific commercial launch dates must be estimated based on the progress of each type.

-

Q: When is the expected commercialization date for sulfide solid-state batteries?

A: The commercialization of sulfide solid-state batteries is expected around 2030. To achieve this, challenges such as efficient lithium sulfide synthesis, interface issues, and cost control must be addressed. Optimistically, partial breakthroughs may occur between 2027 and 2028, particularly in applications like e-VTOL and robotics.

-

Q: What is the progress of oxide solid-state battery commercialization?

A: Oxide solid-state batteries are advancing positively, with CATL having set a 500-day countdown for significant progress by the end of next year. Although there are no technical issues, commercial validation remains crucial. Oxide systems are expected to achieve large-scale production first, potentially incorporating halides and polymers to enhance performance.

-

Q: What is the outlook for polymer solid-state batteries?

A: Pure polymer solid-state batteries are not highly regarded, but their combination with oxides may offer some application potential. The commercialization potential will largely depend on CATL’s progress in this area.

-

Q: Will solid-state battery technology be led by large or small companies?

A: The development of solid-state battery technology is not necessarily led by large or small companies. While large companies have advantages in R&D, funding, and talent, technological breakthroughs could occur in companies of any size. Although large companies like CATL are heavily invested in frontier R&D, many entrepreneurial firms are also exploring this field.

-

Q: Which domestic manufacturers are making significant progress in dry electrode technology? Are there limitations on the use of dry electrode patents domestically, and what are the specific cost reduction effects?

A: There is no authoritative data on specific cost reduction effects, as these must be determined through practical application. Most domestic equipment manufacturers are involved in dry electrode technology, and relevant information can be obtained through publicly available news. The advantage of dry electrode technology is the elimination of solvent evaporation, but challenges remain, such as balancing energy density and uniformity. Although Tesla has made some progress in this area, market validation is still needed. Dry electrode technology aligns well with solid-state batteries, but specific results will take time to observe.

-

Q: Is tantalum a necessary element in solid-state batteries, and are there technical barriers? Will there be a shortage of tantalum?

A: Tantalum, as a fundamental element in lithium lanthanum tantalate or lithium lanthanum tantalum niobate, has broad application potential in solid-state battery. While tantalum usage may vary depending on the application, it is generally not expected to become scarce. The market acceptance and safety of solid-state batteries are key factors, and the amount of tantalum used depends on its specific application in the battery, such as a dopant or coating. Overall, the use of tantalum in solid-state battery is secure, but it is unlikely to cause significant market price fluctuations.

-

Q: Why is the capital market narrative for solid-state batteries focused mainly on emerging small enterprises, with leading companies like CATL and CALB participating less?

A: Leading companies like CATL and BYD have large battery shipments, primarily focused on power and energy storage, with gradually decreasing prices. Solid-state battery have yet to achieve large-scale mass production, and market expectations remain low. If large companies fail to succeed in solid-state battery, they may be seen as lacking flexibility, while small companies, despite having less R&D strength, may attract capital due to high potential returns. The development of solid-state battery requires entrepreneurial spirit and innovation, and while large companies have a more complete layout, market flexibility issues have limited their appeal.

-

Q: Do polymer-oxide composite batteries offer a good cost-performance ratio?

A: Polymer-oxide composite batteries are currently expensive, primarily due to the high cost of materials like LLZO and LAGP. However, these composite batteries provide better safety. Although conductivity is acceptable, poor cost control may affect market acceptance. CATL’s products in this area are worth watching, but whether the market will accept them remains to be seen.

-

Q: Are carbon nanotubes necessary in existing solutions?

A: No single material is absolutely necessary in lithium battery materials. Carbon nanotubes offer excellent performance but are expensive, so market acceptance depends on cost control. Although carbon nanotubes are high-quality materials, their application needs to consider both cost factors and market acceptance.

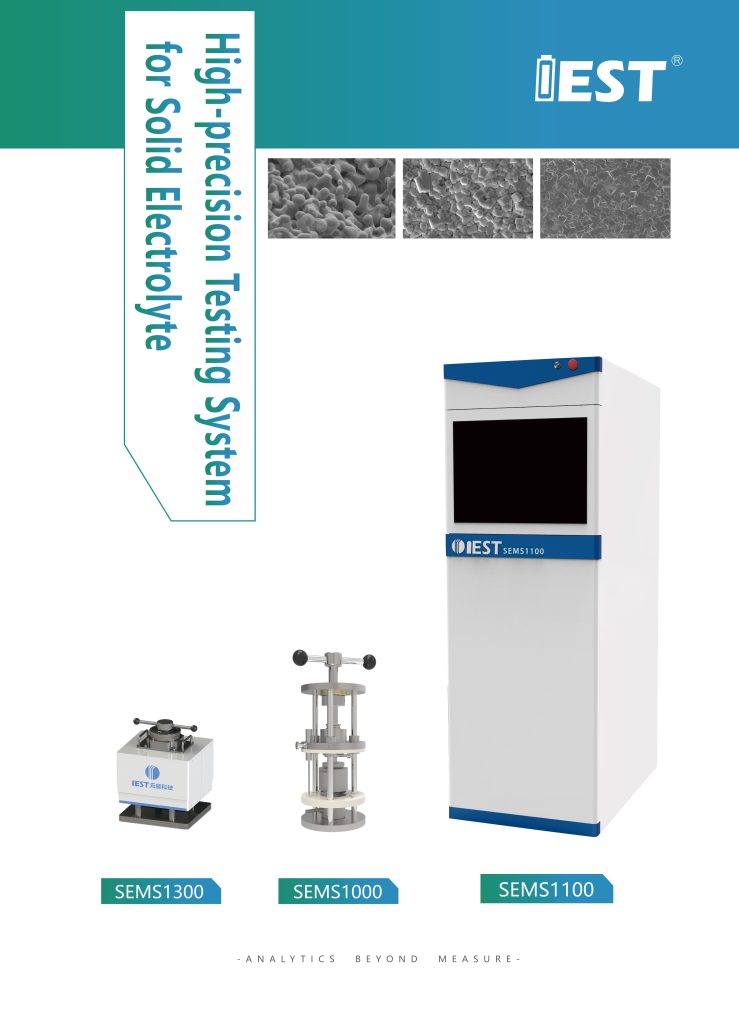

6. IEST Solid Electrolyte Test System(SEMS1100) Recommended

IEST is a high-tech enterprise that focusing on R&D and production of lithium battery testing equipments, a professional manufacturer that integrating laboratory instrument R&D and production, method development, instrument sales and technical services. Committed to providing leading testing solutions and services for the global new energy field.

SEMS1100: A multi-functional testing system dedicated to solid electrolyte samples, a fully automatic measurement equipment for the electrochemical properties of solid electrolytes that integrates tableting, testing and calculation. The system adopts an integrated design, including a pressurization module, an electrochemical test module, a density measurement module, a ceramic sheet pressing and clamping module, etc. This equipment can be used for electrochemical stability window, powder tablets, ionic conductivity, electronic conductivity, solid-state battery cycle performance.

Subscribe Us

Contact Us

If you are interested in our products and want to know more details, please leave a message here, we will reply you as soon as we can.