-

iestinstrument

Lyten Acquires Cuberg Plant from Northvolt to Accelerate Lithium-Sulfur Production

1. Overview

US battery developer Lyten has agreed to acquire a Cuberg battery plant in San Leandro that Northvolt is selling off. The move — effectively a Lyten–Cuberg asset acquisition from Northvolt — will redirect Cuberg’s lithium-metal production assets toward lithium-sulfur (Li–S) manufacture and significantly expand Lyten’s Bay Area capacity to serve defense, drones, micromobility and other energy-storage markets.

2. Deal Highlights & Production Timeline

-

Facility: Cuberg’s San Leandro site — a 119,000 sq ft complex with manufacturing, office and warehouse space — will be repurposed to produce lithium-sulfur batteries.

-

Capacity: The San Leandro plant is expected to produce up to 200 MWh of Li–S batteries once retooled. Commercial production is targeted to begin in the second half of 2025.

-

Investment & R&D: Lyten will acquire Cuberg’s battery cell development business and invest up to $20 million in 2025 to expand both the San Leandro site and Lyten’s existing semi-automated production in San Jose.

-

Existing lines: Lyten’s San Jose pilot line currently runs at about 2–3 MW per year; the San Leandro acquisition will add substantial scale ahead of Lyten’s planned 10 GWh Li–S “super plant” in Nevada, slated to start phased production in 2027.

3. Strategic rationale: why Lyten is pursuing Cuberg assets

-

Faster scale-up: Buying an existing manufacturing footprint lets Lyten accelerate commercial Li-S production versus building from scratch. This acquisition (often referenced as Lyten Cuberg) complements the company’s earlier announcements about a large Nevada plant and growing customer demand.

-

Market fit: Lithium-sulfur batteries offer high gravimetric energy density, lower reliance on scarce minerals, and lighter weight — advantages for defense, UAVs/drones, micromobility and other specialty applications where energy-density and weight matter. Lyten says Li-S cells also align with NDAA domestic procurement requirements, aiding DoD sourcing.

-

Customer pipeline: Lyten reports a rapid growth in customers since early 2024 and expects to allocate capacity across the San Leandro facility and its planned Renault super plant.

4. Broader Implications and Future Expansion

The Lyten Cuberg acquisition is a key part of Lyten‘s larger growth strategy. In October, the company revealed plans to construct a 10 GWh lithium-sulfur gigafactory in Nevada, with the first phase expected to be operational by 2027. The company also intends to pursue further acquisitions of lithium-ion assets to speed expansion.

To support these initiatives, Lyten will hire over 100 new manufacturing employees in the Bay Area. The 119,000-square-foot Cuberg facility—located just 30 minutes from Lyten headquarters—includes manufacturing, office, and warehouse spaces.

CEO and co-founder Dan Cook highlighted the company’s rapid growth, noting, “Since early 2024, our customer pipeline has increased nine-fold, with potential customers now numbering in the hundreds.”

5. Northvolt Context

Northvolt acquired Cuberg in 2021 but has since scaled back US R&D and manufacturing investments. The Swedish group shuttered its San Leandro R&D site and moved development to Sweden; recent troubles culminated in Northvolt filing for Chapter 11 amid production issues and the loss of major customers. Lyten’s purchase of Cuberg assets thus represents an opportunity to redeploy underused US capacity into Li-S production.

6. Funding, partners and strategic positioning

Lyten’s investor roster includes strategic names such as Stellantis, FedEx and Honeywell. The company previously received a multi-million dollar award from the DoD’s National Security Innovation Capital Program to expand prototype manufacturing — funding that complements the firm’s push to meet defense and commercial demand. By acquiring Cuberg’s cell business and facility, Lyten Northvolt (the transaction relationship between the two firms) effectively transfers Cuberg technology and capacity to a US-based Li-S scale-up effort.

7. Outlook

The Cuberg plant acquisition accelerates Lyten’s path to mid-scale commercial Li-S output ahead of its 10 GWh super plant. If timelines hold, the San Leandro line will provide immediate capacity for specialized markets (defense, drones, micromobility) while Lyten ramps toward gigawatt-hour scale in Nevada. The deal also underscores a broader industry shift: strategic buyers repurposing existing battery assets to chase differentiated chemistries and domestic supply chain requirements.

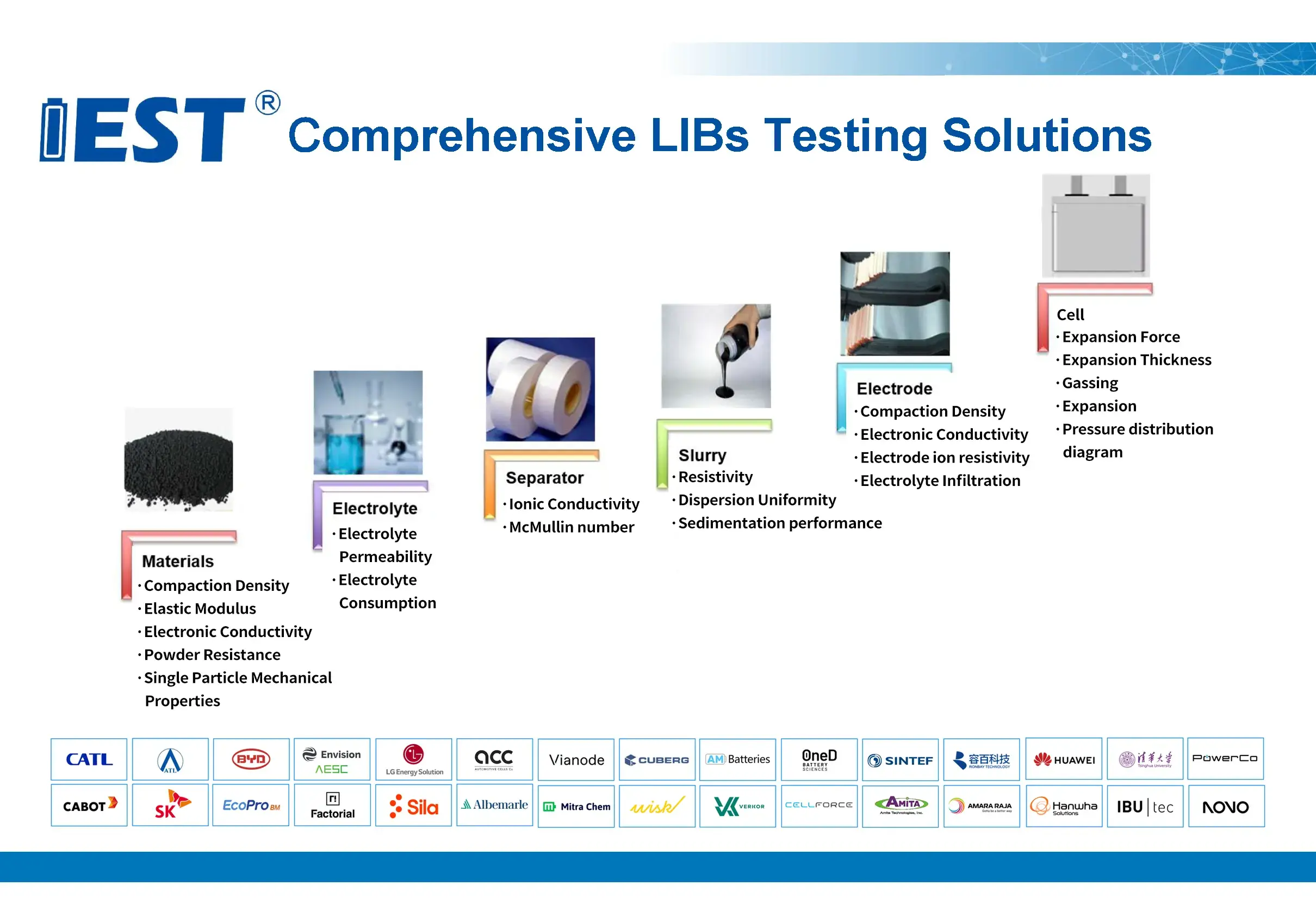

8. Word-leading Lithium Battery Testing Solutions Provider-IEST Instrument

IEST Instrument a pioneer in lithium-ion battery testing, is dedicated to delivering efficient and cutting-edge testing solutions for global electrochemical energy storage, empowering clients to achieve R&D breakthroughs and quality enhancement. The company’s core team comprises seasoned experts in materials science, electrochemistry, and automation, backed by over 100 authorized patents. Its testing equipment has been widely adopted in power batteries, energy storage systems, and materials science research, serving clients across more than 20 countries and regions, including China, Europe, North America, and Southeast Asia. To date, IEST has provided world-leading innovative testing solutions to over 900 global customers, earning widespread recognition for its technological excellence and industry impact.

Contact Us

If you are interested in our products and want to know more details, please leave a message here, we will reply you as soon as we can.