-

iestinstrument

Europe’s Largest Battery Maker Northvolt Announces Bankruptcy Filing Of Its Subsidiary

Summary

- Bankruptcy filing by a subsidiary: Northvolt Ett Expansion AB, which was responsible for the “gigafactory” expansion project in northern Sweden, filed for bankruptcy due to project cancellation. The company’s liabilities are estimated to be approximately SEK 2-3 billion (USD 194-290 million).

- Reasons for the cancellation of the expansion project: Due to financial pressure, Northvolt has decided to cancel the expansion project in order to avoid further weakening of the company’s financial base. This move was made to protect the company’s capital, but has raised questions about Northvolt’s future.

- Overall Challenges in the Battery Industry: The slowdown in demand for electric vehicles, coupled with Northvolt’s downsizing and layoffs announced in September, has further heightened concerns about the company’s ability to lead the European battery industry. This could affect Europe’s competitiveness in the global EV battery market.

- Financing and capital needs: Northvolt has previously raised more than $10 billion from investors, but still needs significant capital to support its expansion. Despite securing a $5 billion green loan, the cancellation of the expansion makes the use of the funds uncertain.

- Competitive pressure from Asia: Chinese battery makers such as Ningde Times and BYD are exerting significant competitive pressure on Northvolt due to economies of scale and technological advantages. European enterprises still need to catch up in terms of production cost and technology.

- Uncertainty in the European market: Despite European policy support for green transformation, the electric vehicle market is not growing as fast as expected, which increases the investment risk for local battery manufacturers.

On Oct. 8, Swedish power battery maker Northvolt said its subsidiary Ett Expansion AB has filed for bankruptcy while other companies continue to consolidate their businesses.Northvolt said in a statement that all issues related to Ett Expansion AB will be managed by the bankruptcy trustee.

According to Swedish news magazine Affarsvarlden, Northvolt filed for bankruptcy subsidiary in the Swedish law enforcement agency (Enforcement Agency) registered in the debt total of 46 million Swedish kronor (equivalent to about 312,400 yuan), the due date for October 7th.

Northvolt said Ett Expansion AB is one of more than 20 different entities within the group and that its bankruptcy filing is not related to other legal entities within the Northvolt Group. In a letter to suppliers, Northvolt said some of the affected suppliers also do business with other Northvolt divisions. The company has a “strong interest” in maintaining these relationships and urges suppliers to “continue to contact us in the normal manner regarding the supply of our products”. In addition, Northvolt will “continue to engage in dialog with stakeholders to continue to work together in the ongoing operations of the Northvolt Group”.

With over $8 billion in debt, Northvolt in deep trouble

Founded in 2017, Northvolt is Europe’s largest domestic battery maker, with more than $10 billion in equity and debt financing from investors including Volkswagen Group.

However, due to its own production woes, weak demand for electric cars in Europe, and difficulty in dealing with competition from China, Northvolt announced in September this year that it would cut costs and lay off 1,600 workers, close or sell some factories, as well as consolidate other factories to massively cut costs, further raising concerns.

In June, BMW chose to cancel a €2 billion (Rs. 15.73 billion) long-term battery contract with Northvolt for 2020; customers such as Volkswagen’s commercial vehicle company Scania complained about delays in Northvolt’s product deliveries; and, in July, the company’s chief executive officer (CEO), Peter Carlsson, said that Northvolt may delay production expansion schedules at four major plants and will abandon plans to build a plant in Sweden to produce cathode active material (CAM) for batteries.

According to Carlson’s currently announced plan, the company aims to achieve 16GWh per year of production in Europe by 2026 and to occupy 25% of the European market share around 2030, three years later than the original plan, with production shrinking by three-quarters compared to the original plan.

On the other hand, the poor performance has also led to Northvolt’s financial constraints. Earnings data show that in 2023, Northvolt’s revenue was $128 million (about RMB 910 million), a year-on-year increase of 19.6%, while the net loss was as high as $1.168 billion (about RMB 8.29 billion), expanding three times year-on-year.

Earlier this year, Northvolt had agreed to a $5 billion (roughly Rs35.27 billion) green loan program with lenders aimed at funding its plant expansion in Sweden, but the cancellation of the construction project last month put the funding at risk.

On Sept. 24, however, a Northvolt spokeswoman revealed that the company had made significant progress in raising capital. A filing revealed that Goldman Sachs and BlackRock have been working to raise additional capital for Northvolt.

Operational obstacles and internal management are part of the reason. It has been reported that Northvolt has a series of negative problems such as worker injuries and toxic chemical leaks.

At the heart of the matter, though, is the fact that the global battery industry is running out of cake to dispense and is extremely competitive. Companies have announced investments of $1.1 trillion in battery and component production between 2024 and 2030, according to Bloomberg data. Countries such as the U.S., Canada, Japan, South Korea, India and Indonesia are looking to attract investment to grow their battery industries.

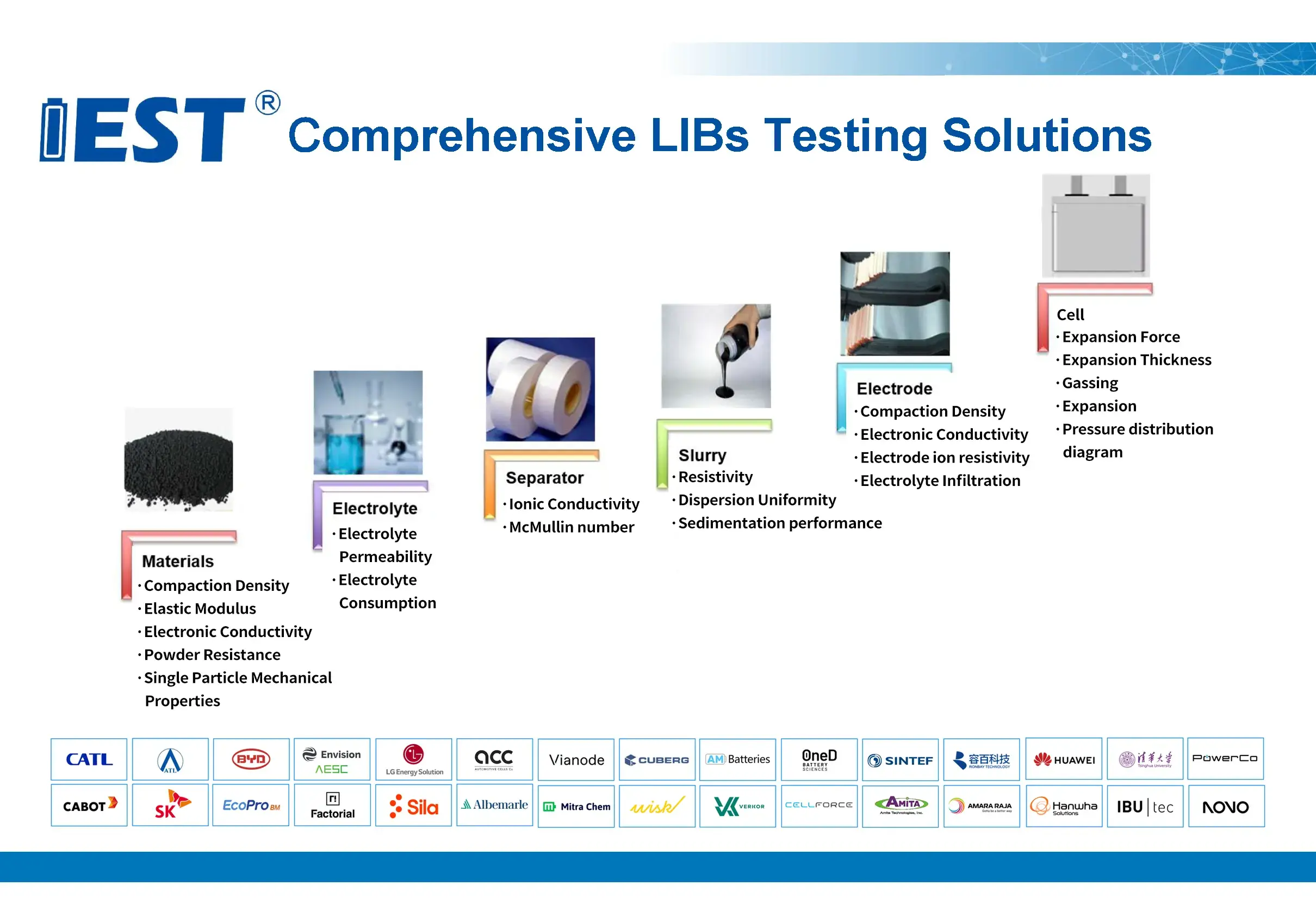

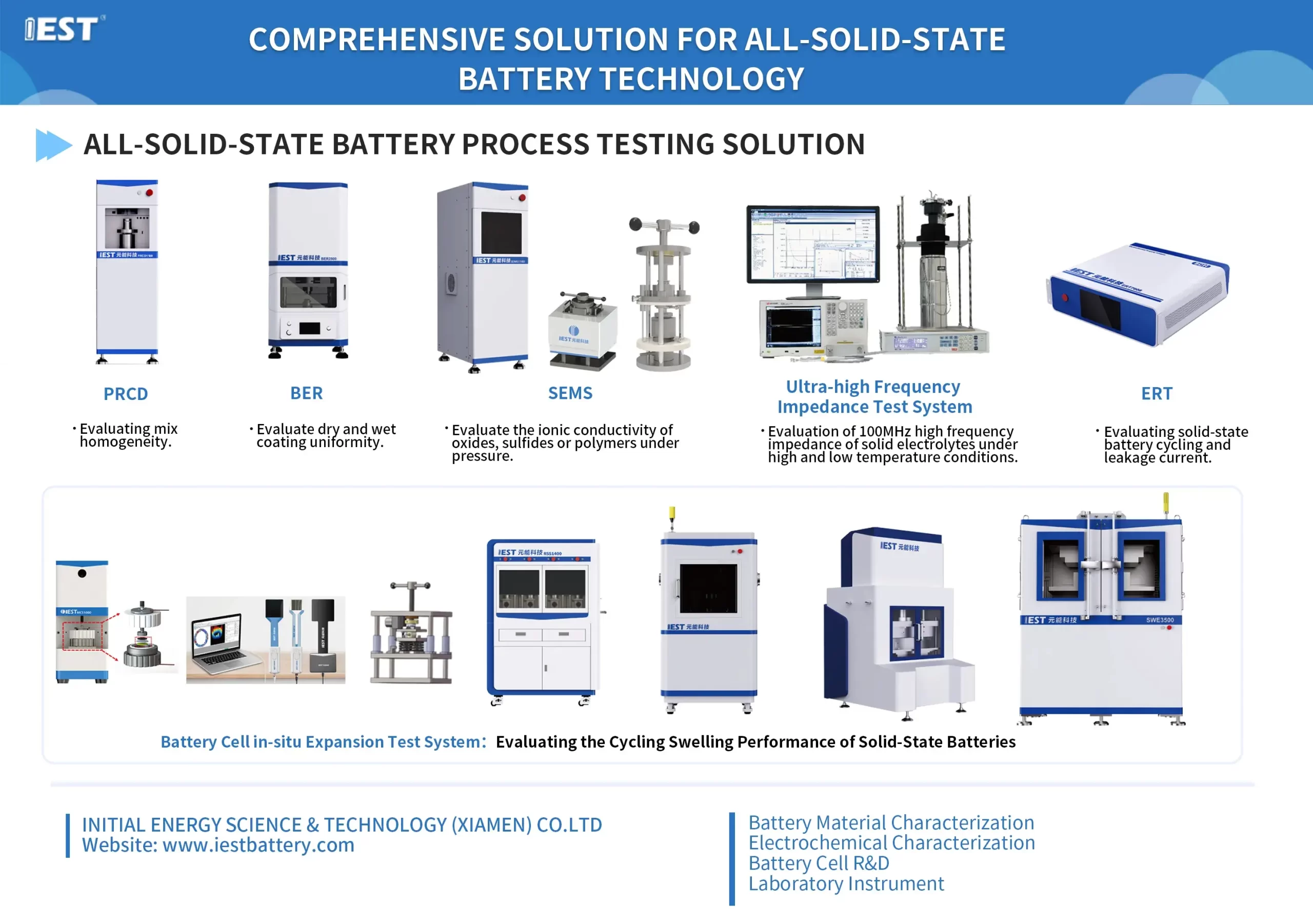

Lithium Battery Testing Solutions Recommend:IEST Instrument

IEST is a high-tech enterprise focusing on R&D and production of lithium ion battery tester. IEST is a professional manufacturer that integrating laboratory instrument R&D and production, method development, instrument sales and technical services. Committed to providing leading testing solutions and services for the global new energy field, IEST company serves key clients like CATL, BYD, Huawei, Svolt, GM, Leyden, Sintef, Factorial, Cabot, Cuberg.

Contact Us

If you are interested in our products and want to know more details, please leave a message here, we will reply you as soon as we can.